I have created what I consider to be a winning formula. My winning formula explains how to trade the market and perhaps more importantly, how to analyze the market. Throughout my 15 year trading career, I have made many important discoveries such as analysis is more important than how you are entering the trade and that there is a third position besides long/short, which is cash- this is where the saying “Cash is King” can be more correct than you think. Stock-Market-Strategy is not only about making money but also about guidance. Imagine if you had been going long in stocks during the IT bubble and the 2007-2008 crash; this eBook would have saved you money, time and heartache as following this strategy would have ensured a safe, trusted trading pattern. In order to succeed you need to get a proper stock market education that includes trading psychology as well as chart analysis.

I have seen many websites selling pipedreams to new hopeful traders. They post some hypothetical results and then claim they are true. They seem to always have the biggest position on in the market when winning and the smallest when losing. If only we could call our broker and ask them to change our buy order quantity AFTER being stopped out!! Another ploy from these websites is that they post profits based on what they COULD have got if they sold at the top. These guys must have nice brokers too seeing they can tell their broker that all sell orders should be executed at the top despite not knowing what the top is until after the end of the trading day!!

However don’t let these con artists scare you from seeking knowledge from other traders in the field as the only way to learn to trade is by learning from those who are profitable. It is paramount that you do your due diligence and don’t get tempted by the fast money. At Stock-Market-Strategy I provide a great service to the trading community which not only fully educates you on the stock market but also forms your trading mindset. This is ideal for everybody, whether you are a full time trader, a part time trader or simply someone who wants to trade their own money alongside their job instead of letting the banks or mutual funds slowly lose your hard earned money.

This eBook will help you to stay on the right side of the market as well as help you decide whether you should be in the market or not. Successful trading is not being in the market 24/7 but more about picking the right times and opportunities where the risk to reward is really good. As Warren Buffett said:

I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches - representing all the investments that you got to make in a lifetime. And once you'd punched through the card, you couldn't make any more investments at all. Under those rules, you'd really think carefully about what you did, and you'd be forced to load up on what you'd really thought about. So you'd do so much better.

The above quote was related to investments but we have adapted that same thinking to our trading. “Don’t try to take profit out of the market. Wait for the market to hand you the profit”.

Before I continue, you have to make a clean start. Forget about buying stocks because some yelling guy (yes, you know who I am talking about!) on CNBC tells you that this stock is hot and it will go up making you a boat load of money. What about that secret tip from a friend who got it from a guy he met on the train or what about buying a stock because you read they came out with record results? The odds are that the stock has already climbed prior to the news. Those people buy for the wrong reasons as they don’t have a proven edge and end up losing their money to the professionals. It is these non-professionals that we make our money off as these traders buy at the top when we are getting out and booking our profit. So we need to outsmart these people and that’s what we are doing here at Stock-Market-Strategy.

The “smart” people on TV don’t know any more than you do. I can guarantee that. They don’t have any secret insider information or special knowledge as they are like you, I and the rest of masses. You need to stop trading based on what should happen and start trading based on what really is happening. A stock can be financially strong and have a great future but that doesn’t mean the stock has to go up. If there are more sellers than buyers, then the stock will drop regardless of how great the company is. You need to have an edge in the market and the only way to achieve this is by using charts as the charts give you all the information you need to know. The supply and demand is written in the charts and they never lie, plus they are objective. All you need is right there in front of you in these charts. You just need a proven strategy. By looking at specific patterns in the charts you can position yourself for major moves in the stock, subsequently outperforming the market plus these patterns identify where the smart money traders are placing their money.

Whether you are a fulltime trader or someone who is looking to trade their 401(K), Stock-Market-Strategy.com and this eBook will prove to be a valuable tool for you as this strategy can be applied on any timeframe. From tick charts to monthly charts. Keep in mind that this ebook is only the beginning of your stock market education as there are several other subjects you need to learn about where one being trading psychology.

As confident as we are in our strategy, we cannot take all the credit for it all as we have obtained inspiration from many books such as:

- Secrets for Profiting in Bull and Bear Markets, Stan Weinstein

- How I Made $2,000,000.00 in the Stock Market, Nicolas Darvas

- How to Make money in Stocks: A Winning System in Good Times and Bad, William J. O’Neil

- The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel, Benjamin Graham

- The Warren Buffett Way, Robert G. Hagstrom

- Point & Figure Charting: The Essential Application for Forecasting and Tracking Market Prices, Thomas J. Dorsey

- Reminiscences of a Stock Operator, Edwin Lefévre

- Encyclopedia of Chart Patterns, Thomas N. Bulkowski

- Trading Classic Chart Patterns, Thomas N. Bulkowski

Chapter 1 – Phases

Whether it’s a stock, commodity or the economy they all move in cycles. Sayings like “what goes up must come down” and “nothing goes up in a straight line” is truer than you think. During the last decade we experienced two bull markets and two bear markets. We have also experienced cycles in the real estate markets. It is needless to say that markets go up and down and we need to be on the right side of the market at any given time. These cycles don’t happen overnight and can take months or years to develop.

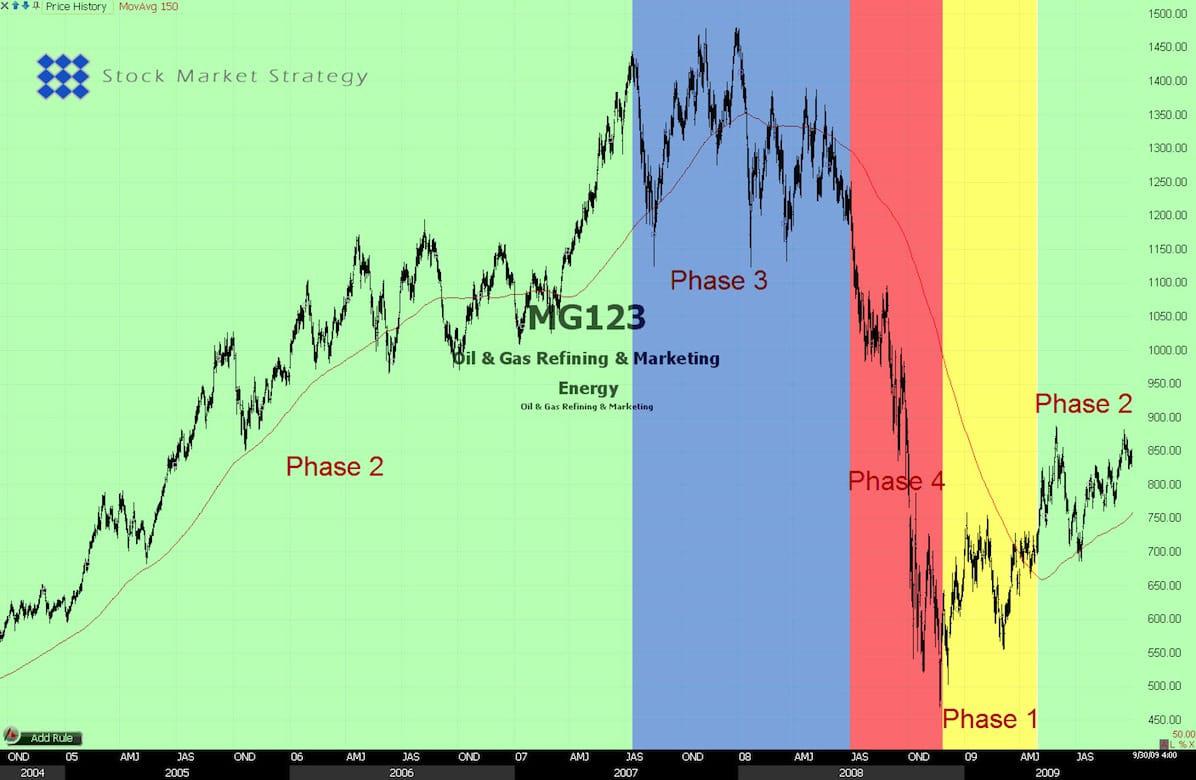

To get a better picture of these cycles we divide the market, sector or stock up into 4 different phases.

- Phase 1 is a basing phase before the uptrend. This phase experiences accumulation by the big banks and institutions.

- Phase 2 is the uptrend after a stock breaks out of phase 1. This is when the stocks advances and get attention from retail investors and traders.

- Phase 3 is the topping price action where the late comers tend to buy. They have seen the price climb and feel like they are missing out.

- Phase 4 is the down trend that occurs after a break of support in phase 3. This is where many retail investors and traders think they can go bargain hunting as the stock appears to be cheap.

Chart example of SP-500 showing all 4 phases. Every market index or stock will sooner or later experience all 4 phases in the cycle; basing, advancing, topping and declining.

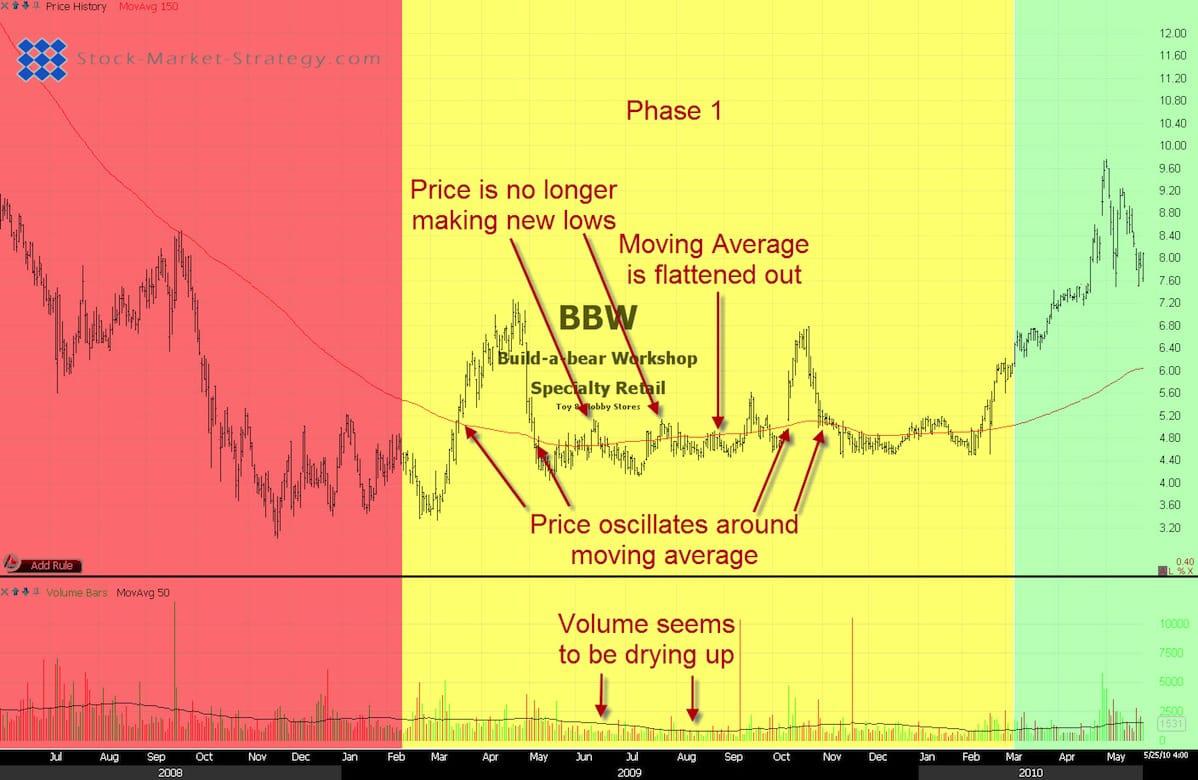

Phase 1

After a long lasting drop in price for stock X, it will eventually slow down and start to trade sideways. It is here where there are an equal amount of buyers and sellers. Price is no longer making lower lows and lower highs and volume is often drying up as heavy selling has come to a halt. When using a moving average on a chart you will see that it will flattens out and price will oscillate around the moving average. Price will often bounce between support and resistance. During this phase it is advisable to stay on the sideline and wait for break above resistance. You cannot be sure that this is a phase 1 until breakout as occurred. This phase 1 could turn out to be sideways price action before a new leg down. During a phase 1 the news surrounding a stock tends to be negative this is because a drop in a stock often precedes the news.

Chart example of BBW showing a phase 1 with key things happening. Price oscillates around the moving average which has flattened out. Price is no longer making new lows which means that the downtrend has come to an end. Volume is diminishing indicating selling pressure is coming to an end.

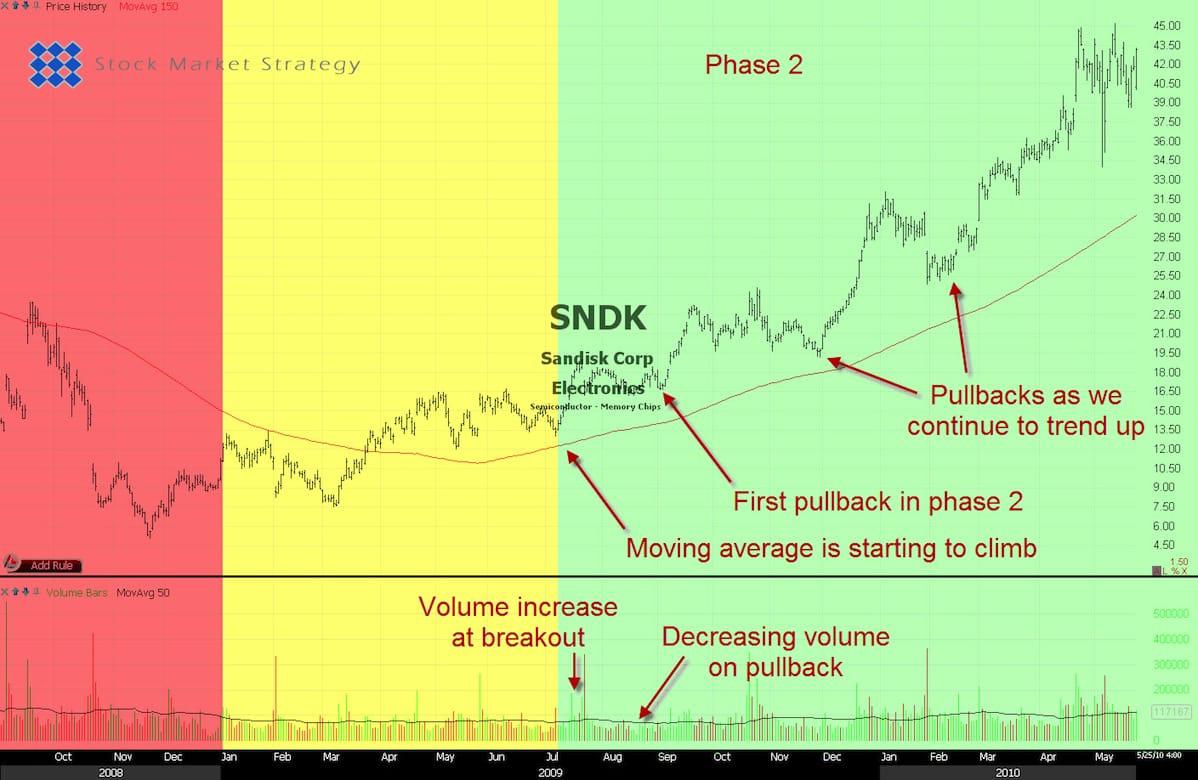

Phase 2

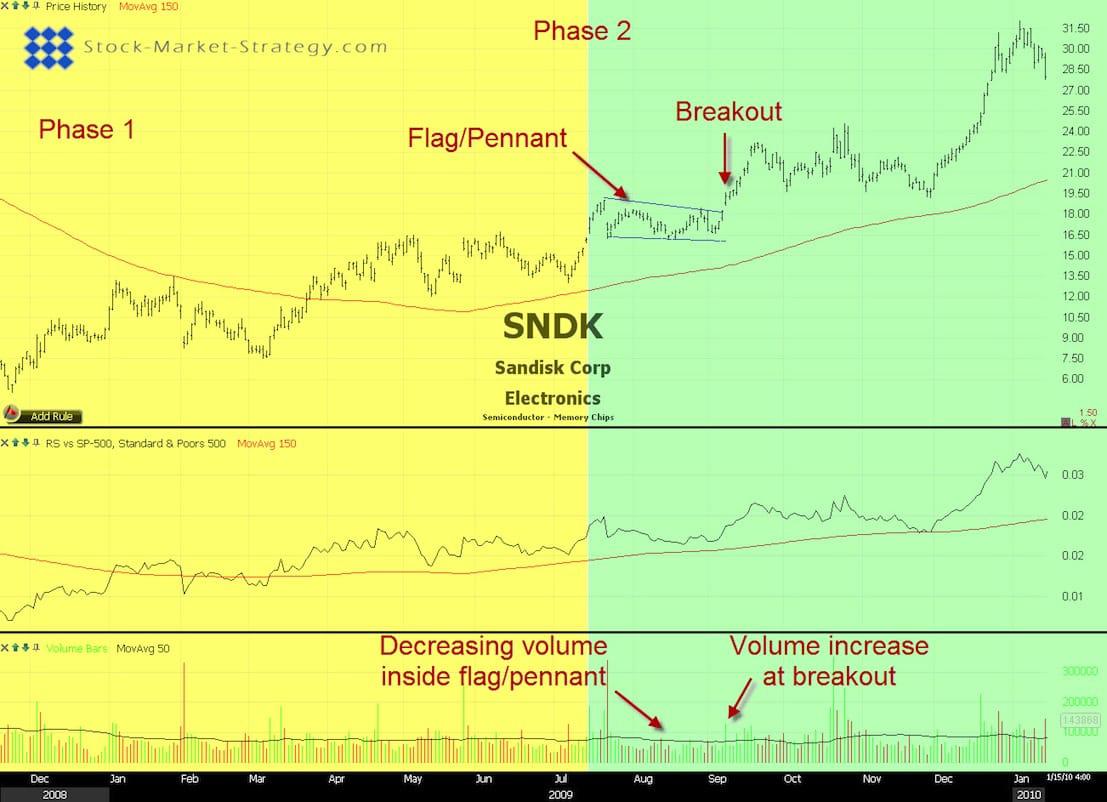

After the break of resistance, preferably with volume surge, is the phase 1 confirmed and we are now in phase 2. You will often see an initial rally as traders are short covering therefore adding to the rally. The breakout gives you the first opportunity to go long. The rally should be extensive enough so your moving average has started to climb. After the rally you will more often than not see a pullback to the breakout area. This pullback should be on the decreasing volume. That’s your second opportunity to go long. This second entry is giving you a high odds trade as you have got the evidence of a new uptrend before going long. As the uptrend continues you will experience several pullbacks to the moving average, all giving you an opportunity to go long. Just bear in mind that the longer we are in phase 2, the closer we are at entering phase 3.

If you analyze the stocks earnings you will often see that they are somehow bad as the time of breakout. This is because the stock/market always climbs prior to news. As we continue to climb, the fundamentals improve and the stock will become main stream. You should refrain from making any new ‘buy’s’ and only hold on to current positions. There is a saying which could be applied to this “buy on rumors, sell on news”. However this doesn’t mean that when a company comes out with good earnings you should sell or short the stock.

Chart example of SNDK showing a phase 2 with key things happening. When entering phase 2 we are seeing a volume increase validating the transition. We are seeing the moving average starting to climb and keep climbing the further we move into phase 2. Several pull backs occur giving the trader plenty of opportunities to enter a long position.

Phase 3

In the end of phase 2, price loses momentum and the moving average starts to flatten out. Price will then oscillate around the moving average. You will experience increased volatility as the price will swing rapidly. Traders are buying the news. They are excited about all the good earnings lately. In the mean time all the early phase 2 buyers are booking their substantial profit. This results in increased volume.

You have probably taken half your position off and now you have tightened your stop. You want to stay in the trade as this potential phase 3 could turn out to be sideways price action before a new leg up.

Chart example of VRSN showing a phase 3 with key things happening. We are seeing increased volatility as the swing highs and lows are further from each other. Price is oscillating around the moving average which is starting to flatten out.

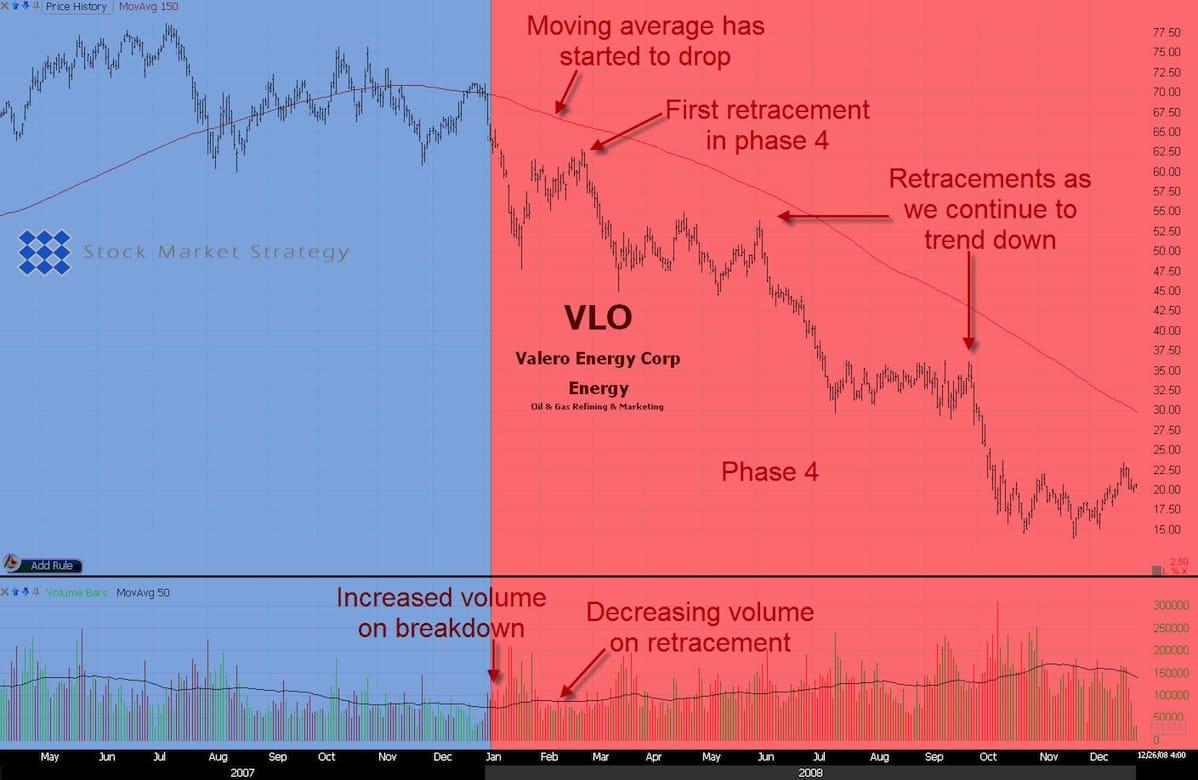

Phase 4

When price takes out support in the phase 3 we have confirmation that it was a phase 3 and we are now in a phase 4. This is the time traders ignore the signs and keep buying on the way down. They believe the stock is cheap because it has now dropped X%. But what can appear to be a cheap buy can easily turn into an expensive and costly mistake as the stock’s decline continues. Never buy a stock in a phase 4 regardless of how cheap it might look.

The breakdown doesn’t need to be accompanied by heavy volume. A stock can drop without heavy volume, it just needs a lack of buyers. Of course if you do see increased volume you have extra evidence pointing to a nice phase 4.

Identify the phase 4 so you avoid losing money. If you don’t mind shorting stock then this phase can give you tremendous gains as stocks tends to drop faster then they go up.

The first opportunity to go short is when we see the breakdown into phase 4. Just like in phase 2, price tends to then retrace back to the breakdown area, where what was support is now resistance. This gives you another great opportunity to go short. As the breakdown is well underway the moving average will drop as well. Retracement back to this moving average will give you several other opportunities to enter a short position. Bear in mind that the longer the phase 4 has been underway the closer you are to phase 1. This is even more important during phase 4, as previously mentioned, A stock drops faster than it climbs, making phase 4 shorter than phase 2.

Chart example of VLO showing a phase 4 with key things happening. When entering phase 4 we are seeing an increase in volume and the moving average is starting to drop. The moving average will keep dropping for the duration of phase 4. Several retracements are occurring giving the trader plenty of chances of entering a short position.

Chapter 2 – Sector Analysis

The market is made up of many different sectors, such as the Semiconductor sector, Banking sector, Energy sector and so forth. When the market is in a phase 2 you will often experience the majority of sectors in a phase 2 as well. Some sectors have a bigger impact on the market as they are made up of bigger stocks in terms of capitulation but it’s important to keep an extra eye on these sectors.

Some sectors go into a phase 2 or 4 before the market does and some go in and out of phases during a phase 2 market. However one particular sector doesn’t need to follow the market. A good example of this is that the Financial sector was already well into a phase 4 when the market went into phase 3 in 2007. Another example is that when the market went into a phase 4 in January 2008 some sectors were still in phase 2 and only went into phase 4 approximately 6 months later. Despite the market being in a downtrend it doesn’t necessarily mean that the sector of the stock you are looking at is in a downtrend.

Mutual Funds and Hedge Funds are looking to outperform the market. This is because, by trying to reach the goal of outperforming the market, they have to be proactive. Therefore they are moving money from one sector to another hoping to catch the next leader. First year it could be the Energy sector, next year the Precious Metal sector. The reason for moving the money around is that a sector will rarely outperform the market the whole time the market is in a phase 2 or underperform the market in a phase 4. Furthermore a sector might outperform the market but it might underperform another sector. You want to be in the best sector at all times when the market is in a phase 2.

We have experienced many stocks struggling to outperform the market simply because the sector the stock belongs to was in a phase 4. You then see a stock with the exact same pattern outperform the market simply because it belongs to a strong sector in a phase 2.

When buying a phase 2 stock in a phase 2 sector you are leveraging yourself. You are improving the odds of success. When one stock goes up there is a risk that the stock is climbing on hot air but when you are experiencing several stocks in the same sector getting bid up then the chances are that the smart money is moving into these stocks. When a sector climbs as a whole versus a single stock the odds are that there is something fundamental in the economy that supports this climb. For example, the Energy sector, especially the Oil sector, rose and outperformed the market from 2003 to 2007 because of oil prices climbing. However, when a sector drops versus a single stock there is probably something critically wrong. A great example of this is in the previously mentioned Financial sector. This sector, which was the biggest sector at the time, was in a phase 4 long before the market and we all know now that there was something deeply wrong. By studying this sector you could have been pre warned.

hart example of a sector showing all 4 phases. Just like the market or a stock a sector will sooner or later also experience all 4 phases in a cycle.

During a bull market we go through 209 sectors on a regular basis to see what sector is seeing increased buying. We look for volume increase and for breakout into phase 2. We use TC2000 for this task. It’s an incredible software which is easy to use but the best part is that Worden has divided the stocks up for us. They have divided them up into Main Industry groups and Sub Industry groups according to Morning Star. They have done all the work for us. We then scan through the sectors automatically and manually for phase 2 and phase 4.

Chapter 3 - Relative Strength

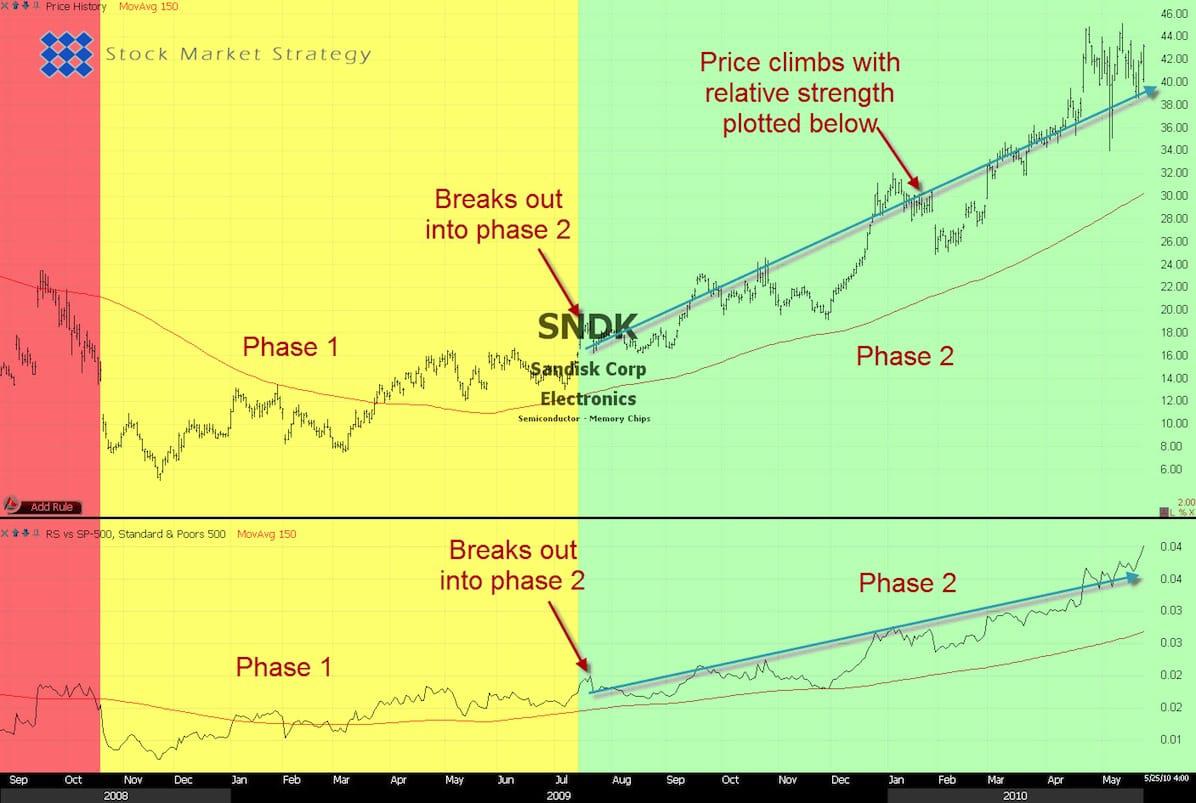

This is an often overlooked but powerful tool. Relative strength (RS) is showing how one stock is performing against another stock, sector or market index. It’s often plotted as a graph beneath the instrument you are analyzing. It tells you if the stock you are looking at is rising relatively more or less than the market or dropping relatively less or more than the market. This is an important feature as trading the stock market is about outperforming the market average. So what better tool to use than relative strength! We use SP-500 as our market average. The reason why we use the S&P 500 is because is made up of more stocks than Dow Jones 30 and Nasdaq 100. This gives us a better sample of the market. Furthermore the S&P 500 is the most actively traded index future.

A comparison of a stock with SP-500 gives 4 scenarios:

- Price ↑ + RS ↓ = Stock climbs less than SP-500

- Price ↑ + RS ↑ = Stock climbs more than SP-500

- Price ↓ + RS ↑ = Stock drops less than SP-500

- Price ↓ + RS ↓ = Stock drops more than SP-500

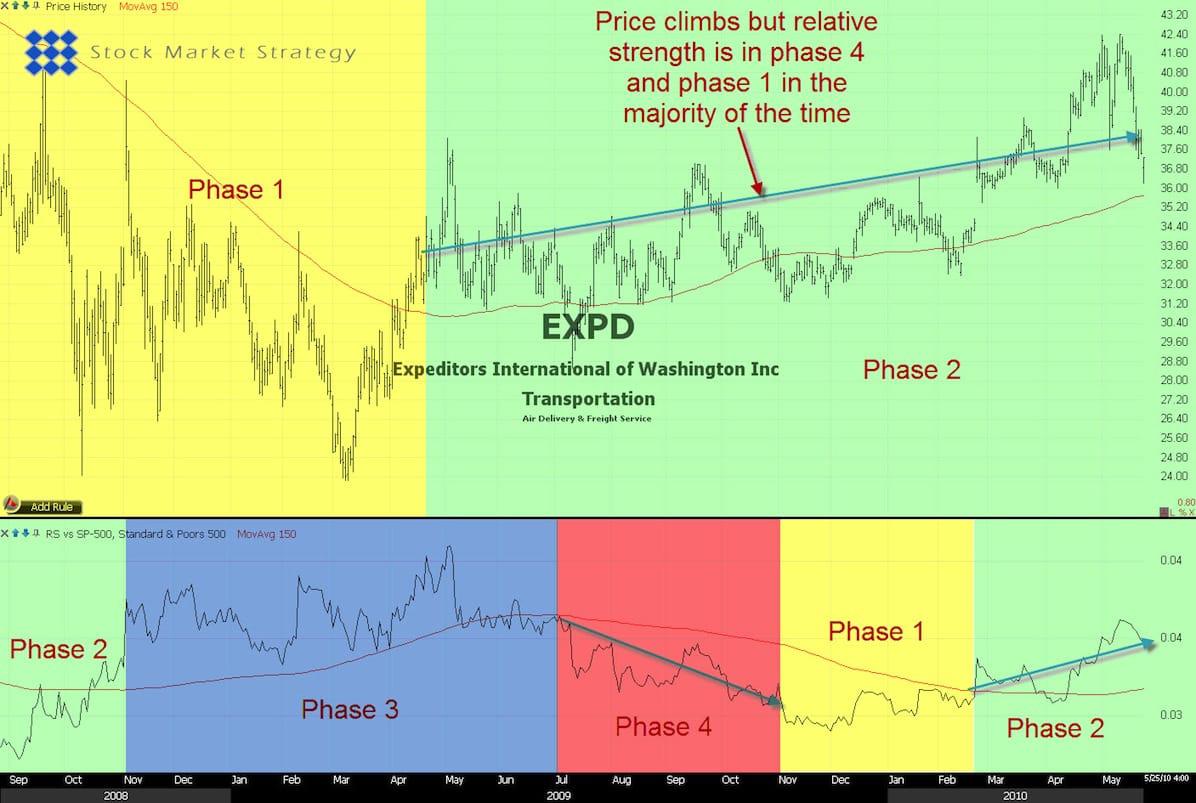

We are only interested in the ones where the arrows match. We want a stock or sector to climb together with the RS and we want a stock or sector to drop with RS. Buying a stock with falling RS means we are buying a weaker stock than the average. This will give us less profit than market average therefore underperforming the market. Also by buying a relative weak stock we are at a higher risk of getting stopped out if the market sells off.

But why are we interested in sectors and stocks that have already outperformed the market? Who says they will continue to outperform the market? Perhaps it’s better to buy a stock that underperforms and then hope it will turn around and outperform the market? No one can guarantee that a stock will continue to outperform the market but it is likely to do so. The reason for this is that statistically the stocks that double first are likely to be the first ones doubling again.

Now that we have looked into sector analysis to help us outperform the market we will look into this tool to see how the sector and stock are doing relative to the market average. It’s not enough that the sector and stock are in a phase 2 or phase 4. We need to be sure that the sector and stock we are exposed to really are outperforming the market or underperforming for that matter. This relative strength tool, which is an objective measurement, is informing us of this.

When doing the sector analysis you want to locate those sectors that are showing relative strength against the market. This is easiest done by determining the phase the relative strength is in. If the sector is in a phase 2 you want to make sure that the relative strength is in a phase 2 as well. This means that not only is the sector in an uptrend but it’s also climbing more than the market average. Of course if you want to short a stock then make sure that the sector and the RS is in a phase 4.

Chart example of a sector showing relative strength against the market – SP-500. Price of the sector climbs at the same time the RS climbs. This means that the sector is climbing relative more than SP-500.

After comparing the sectors with the market you also want to compare the stocks in that sector with the market as well. You need to make sure that your stocks that are in phase 2 are also experiencing a phase 2 in relation to the relative strength versus the market as just because the sector as a whole is outperforming the market doesn’t mean that every stock in that sector is showing relative strength. This can be done the same way as when you look for relative strength in the sectors.

Chart example of SNDK showing relative strength against the market – SP-500. Price is climbing while RS is climbing as well. This means that SNDK is climbing relative more than SP-500. This is what a good stock should do.

Chart example of EXPD showing relative weakness against the market – SP-500. Price is climbing but in the beginning of phase 2 the RS is dropping. This means that EXPD is climbing relative less than the market and thereby a bad trade. Notice that when the RS starts to climb is when EXPD moves up significantly.

Now we have done relative strength comparison with the market for both sectors and stocks which will help us to choose the right trades. But we can do one last thing which is comparing those stocks with each other. So not only are we looking for the strongest (or weakest) stocks in the strongest (or weakest) sector but we are also looking for the strongest stocks among the strongest stocks. Sounds complicated? Not at all. Instead of using relative strength calculation we just list the chosen stocks and look at percentage increase (or drop) over a fixed period.

So let us recap on what this relative strength comparison has done. We found the strongest sectors, scanned for the strongest stocks in that sector and then we compared those strong stocks to find the leader of the chosen ones.

It is important you do it in that order. Yes, you can find even stronger stocks (but is that luck?) against the market that won’t come up in your end list (because the sector is weak) but that’s ok. It’s not about finding the strongest stock in the market, it’s about finding strong stocks consistently again and again, and by using sector analysis you are increasing the odds for this. As you continue you to educate yourself in stock market trading you will learn to think like a professional trader.

Chapter 4 – Entries

As previously mentioned we believe that analysis is more important in trading than the entry signal itself but this doesn’t mean we enter a stock without technical setup. As a matter of fact, we use well known and proven entry signals. We use chart patterns as they have existed since the beginning of trading and because they are real time tools. They don’t lag like many technical indicators do. This means we will be trading based on current price action and reacting on current events. Furthermore they capture the psychology of the traders and represent supply and demand, the same supply and demand that moves a stock.

As our analysis is based on chart analysis with the exception of moving averages and relative strength, then it seems natural to choose chart patterns for entries as they are part of chart analysis. We have real time analysis so we want matching real time entries. Besides, we believe chart patterns are simple to use therefore supporting our belief that trading should be simple. We work with this acronym in mind;KISS which means Keep It Simple Stupid! This is the main reason we don’t trade the more exotic patterns. There is absolutely no reason to complicate trading with unnecessary things.

We only go long in a phase 2 and only short in a phase 4 meaning we need to trade continuation patterns as these phases’ mean that we are already in an established trend so you can see that we have removed reversal patterns in our trading arsenal. We only enter using these continuation patterns:

If you click on the links you will find all the chart patterns explained accompanied by charts and videos. We recommend you watch them so you understand how to trade them correctly.

Chart example of SNDK forming a Flag – Pennant. SNDK is in a phase 2 while forming a Flag – Pennant with decreasing volume. Entry happens when price breaks out with a volume increase.

Chart example of SLW forming a flag. SLW is in a phase 2 while forming a flag with decreasing volume. Entry is when price breaks out with a volume increase.

Chapter 5 – Top Down Approach

After reading this eBook we believe that you will now have a very good insight in our trading strategy. You should also know that we don’t focus on the quantity of trades but more on the quality of trades. We do a substantial amount of analysis on several layers in order to pick the best stocks.

I will now walk you through what we call the ‘Top Down Approach’ which is exactly what it sounds like in that we approach our trading from the top and work down. We will use the previous chapters and gather them into one easy recipe for success. If we wanted to condense everything in the previous chapters down to one word we would have to invent one: MASATA. It stands for: Market Analysis - Sector Analysis- Trade Analysis! Though the word has no meaning to you, it’s actually what has made us successful. It’s very important that we do it in that order and the word helps us stay focused on the right order. Don’t let a single stock choose you, let the market choose the right one for you!

Market Analysis

Before even considering to trade we have to check the overall market conditions, and in our case we use the SP-500 to see if we should even be trading and if so, what side should we be on and whether it is long or short? We identify the phases of the SP-500. We look to the left of the chart to see what price action has done prior to where we are now. That makes the analysis easy for us as we know that after phase 1 comes phase 2 etc. So spend some time looking at the SP-500 so you can be sure you are with the market.

After identifying the phase, for example phase 2, we then look how far we are into the current phase. The further we are into a phase then the less aggressive we will be in our trading. For example, waiting for more evidence, fewer trades, smaller position size, exiting a position instead of trailing it and so forth. This is the first step and when it’s completed we move on to sector analysis.

Chart example of the market – SP500. The chart shows that price is currently in a phase 2. This means we are only looking for strong sectors and strong stocks which is where a long trade can be initiated.

Sector Analysis

Here we locate the sectors that are in the same phase as the SP-500. If we use the above mentioned example of phase 2 we want to find the sectors that are trending up in phase 2. So we filter out all sectors that are going in the opposite direction of the market.

We have now found the sectors that go up with the market but we want to make sure they are leading the market instead of them being dragged up by the market. It’s not enough just to check whether they are in a phase 2. They can still underperform despite climbing with the market, so here we implement our relative strength tool. We want to do a relative strength comparison with the SP-500 and filter out all those sectors that don’t have a relative strength in a phase 2. This is very important.

Finally, when doing sector analysis make sure that the sectors that are left after filtering have more than 1-2 advancing stocks. This is to avoid having fake believe in a sector attracting the smart money, when in truth there are only one or two stocks that perform so well that they pull the rest of the sector up. Make sure it’s the sector as a whole which seems strong. Of course you will VERY RARELY find all stocks climbing at the same time but the majority should.

Chart example of sector Diversified Electronics. The chart shows us that the sector is in a phase 2 which is congruent with the market – SP-500. The chart is also showing us that the sector is relative strong against the market. The sector is outperforming the market meaning it is the right place to look for strong stocks.

Trade Analysis

To continue with the aforementioned example of phase 2 we will look for stocks in phase 2 in the few remaining sectors. The market, sector and stock all need to be in the same phase. We leverage ourselves by doing this and increasing the odds for success.

After finding multiple stocks in the same sector with a clean and well defined phase 2 you will have to rank them by looking at the percent change over X amount of days (bars if you are trading Intraday). Then pick the top 2 or 3 stocks. By choosing more than 1 stock you are minimizing the risk. 1 stock might come out with bad news but 2 or 3 at the same time? I highly doubt it.

Put these stocks in your watch list and wait for entry signal. Don’t just jump into the trade because you have done your analysis. Wait for a good risk to reward entries by using the previously mentioned chart patterns. If you feel more comfortable using indicators feel free to use, RSI, Stochastic, MACD for example, or any other indicators you are comfortable with. It is paramount that you know the rules and understand the indicator that you use and you for entry.

Chart example of PWER. The chart is showing us that the stock is in a phase 2 which is congruent with both the market and the sector. The chart is also showing us that it is showing relative strength against the market. The stock is outperforming the market which is what we are looking for. This stock is a market leader and not a follower.

Final Summary

The Winning Formula Trading Strategy has been compiled from years of trading experience and huge research and development so you can rest assured that this is one trading strategy that you will want to be implementing with immediate effect. As mentioned earlier this eBook should only be a small part of your stock market education so please take advantage of our free trading videos.

There is a lot to digest and we suggest that you read the Winning Formula a few times and become extremely familiar with the way in which we implement our trading strategy. We also suggest reading the vast educational section of Stock-Market-Strategy.com highlighting some of the important technical analysis indicators, chart patterns and trading psychology which you need to master to become successful as a professional trader. This educational material has been documented for you so you can have a better understanding of the market as well as getting to know us as traders better and the way in which we trade.

We hope that you have gained some useful insights into the way in which we analyze the market and execute positions. If you have any questions big or small regarding anything within this eBook please do not hesitate to contact us.

Wishing you every success in your trading career.