Day Trading is one the hardest things to succeed at so we have to use every tool in our arsenal to increase the odds of success. One of the tools is using filters. Filters are used to determine which side of the market you should trade from i.e from the long side or the short side.

Just because you see a bear flag for example does not mean you should go short. If the intraday market is bullish you should skip that bear flag and wait for a bullish signal such as a bull flag.

In this video I show you 4 different methods to help you stay with the winning side intraday. These methods are used by many traders for one reason: They are easy to use but very powerful!

4 Different Methods To Obtain A Day Trading Bias

Prior Day High/Low - If price is above prior day high then the bias is long. If price is below prior day low then the bias is short.

Opening Range - If price is below the first 15 or 30 min then price is considered weak and if price is above the opening range then it is considered strong. This is not as strong a filter as when using Prior Day High/Low

Moving Average - Unless you are a brand new visitor you have noticed that I use Moving Averages a lot. I use them to determine the trend and in this is case I do the same. If the trend is down then my bias is short and if the trend is up my bias is long.

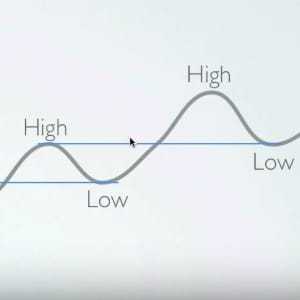

Phase Analysis - This is just like Moving Average, something we practically use for every strategy. When market is in a phase 2 then our bias is long and when market is in a phase 4 we short.

As always feel free to leave a comment below if you have any questions or feedback you want to give me.