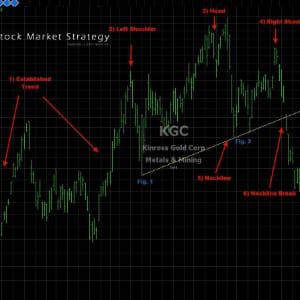

Inverted Head and shoulders are known as a reversal chart pattern and are formed after an extended price move to the downside. The completion of this pattern denotes a trend reversal and in this case from a downtrend to and uptrend.

You can identify the Inverted Head and Shoulder chart pattern when doing your chart analysis by its distinct left shoulder, head in the middle, right shoulder all contained by a prominent resistance area which is known as the neckline.

Identify the Reversal Chart Pattern for Profitable Trading

As with all the other chart patterns these come in other variations and by that we mean that is sometimes left shoulder can be lower than right shoulder or right shoulder can be lower than left and sometime they can be equal.

These Inverted Head and Shoulders reversal chart patterns like other pattern analysis comes into its own when significant areas of support resistance are broken and confirmed.

Steps on how to Identify:

- Establish Trend - The Inverted Head and Shoulder like any other reversal chart pattern must be a long term established trend to reverse. Inverted Head and Shoulders have to be formed after a significant downtrend.

- Left Shoulder - This price action is normally contained in the downward major trend line within the significant downtrend and you will see that the price will test the trend line which will also correlate to what will later become the neckline.

- Head - After the left shoulder has been created and price action starts moving downwards, you will see it will take out the prior pivot low of the left shoulder making a new low. At this point keep an eye on volume as you will normally see it dry up and the price will start retracing back to the area of support (neckline).

- Right Shoulder - Now the area of support has been created the price action can now begin to test the price action of the head. This pull back will exhaust itself before reaching the low price of the head and will be known as what we call a failure to take out previous low. This is the first major bullish signal.

- NeckLine - Now the left shoulder has been formed and the head is starting to retrace down to create the right shoulder we can draw in what we call a neckline (trendline). This can be drawn off the retracement of the left shoulder Fig.1 - Fig.2 which is when the price pulls back to create the right shoulder.

- Neckline Break - Now that the right shoulder has been established and price has been rejected price will retrace to the neckline area. As the pattern has been created over a 2-3 month period the neckline area will more often than not be tested a few times before breaking. Only after the resistance of the neckline has been broken and the price action has closed above neckline support can we be sure that the pattern is confirmed.

- Support - What was neckline resistance is now neckline support and more often than not will be tested by the price and rejected. This is the chance for you to either exit all short positions from previous downtrend or enter your long position in the market.

Spotting the trend reverals using the Inverted Head & Shoulders pattern

Styles Traded - Ways in which the pattern can be Traded:

- Very Aggressive - When price action of the right shoulder fails to fall below the price level of the head and reverses in an aggressive manner. Implement a candle stick formation for entry. This is considered a low odds trade and you will be stopped out more often.

- Less Aggressive - Price breaks neckline resistance area and closes above. This has a bigger stop loss but is more confirmation that it's on its way up.

- Might Miss - Price retests the neckline resistance area which is now the support area.

How to trade the Inverted Head & Shoulders chart pattern

All three trading style entries have their strength and weaknesses and will come down to the trading style of the individual trader and their tolerance to money management (R&R).